Max 401k Contribution 2025 Over 50. You can contribute to more than one 401 (k. In 2025, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500.

While you can save quite a lot in a 401 (k) every year, you can’t contribute an unlimited amount: Employees can contribute up to $23,000 to their 401 (k) plan for 2025 vs.

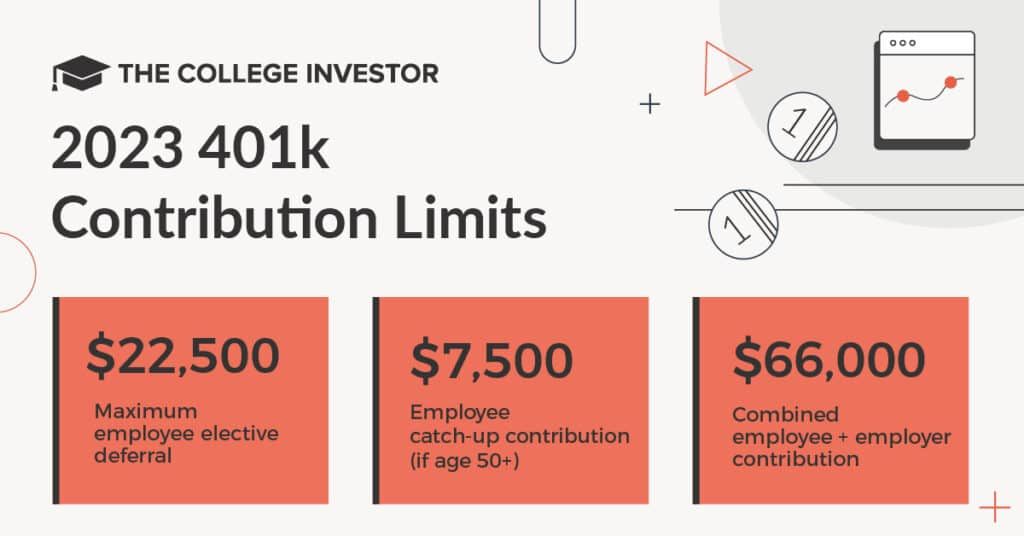

Max 401k Catch Up Contribution 2025 Over 50 Marga Salaidh, The 2025 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

401k Contribution Cap 2025 Cindy Deloria, In 2025, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500.

401k Maximum Contribution 2025 Calculator Over 50 Vera Malena, The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2025.

401k Max Contribution 2025 Over 50 Calla Merilyn, Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50.

What Is Max 401k Contribution 2025 Over 50 Dalia Eleanor, Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2025—for people under age 50.

Max 401k Contribution 2025 Over 50 Benefits Jessy Elfrida, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.

Maximum 401k Contribution 2025 Over 55 Betta Charlot, The 401 (k) compensation limit is $345,000.

2025 Max 401k Contribution Over 50 Alexa Harriot, The 2025 contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

Max 401k 2025 Over Age 50 Buffy Coralie, Those 50 and older can contribute an additional $7,500.

What Is Max 401k Contribution 2025 Over 50 Dalia Eleanor, The contribution limit on individual retirement accounts will increase by $500 in 2025, from $6,500 to $7,000.